Senegal is facing a severe financial crisis after the new government uncovered billions of dollars in hidden debt. Fiscal audits revealed that the budget deficit and public debt were far higher than previously reported by the former administration. The findings prompted the International Monetary Fund (IMF) to suspend a funding program worth nearly two billion dollars. This revelation shook investor confidence and raised serious questions about Senegal’s fiscal transparency.

Deficit Doubles in Scale

The Court of Auditors revealed that by the end of 2023 the deficit had reached more than 10 percent of GDP. This figure is double the official numbers, which previously reported a deficit of about 5 percent. Public debt was also revised upward from 74 percent to nearly 100 percent of GDP. Some analysts even placed the figure closer to 119 percent, meaning hidden liabilities of roughly 13 billion dollars.

The report triggered shockwaves in financial markets. Senegal’s eurobonds tumbled, while borrowing costs soared. Barclays and S&P Global placed Senegal among Africa’s most debt-distressed countries. The new government is under growing pressure to restore investor trust and secure renewed international support.

IMF Suspends Its Program

The IMF, which had approved a financing program of around 1.8 billion dollars, decided to suspend disbursement until Senegal provides greater transparency. “We need full data and clear remedial measures before resuming the program,” an IMF spokesperson told Reuters.

This decision further worsened Senegal’s fiscal troubles. Without IMF funds, the government struggles to cover immediate budgetary needs. Infrastructure projects risk being delayed, while public services face potential cuts.

Government’s Recovery Plan

Prime Minister Ousmane Sonko announced a recovery strategy that relies heavily on domestic financing. The government pledged to fund up to 90 percent of its recovery plan from domestic sources without taking on new foreign debt. Another key measure is economic rebasing, or recalculating GDP, which was last done in 2018. The rebasing is expected to make debt-to-GDP ratios look more sustainable.

The government has also postponed quarterly budget execution reports to ensure accuracy in published data. Transparency is now the central pillar of its fiscal reform, as credibility must be rebuilt from the ground up.

Social and Political Impact

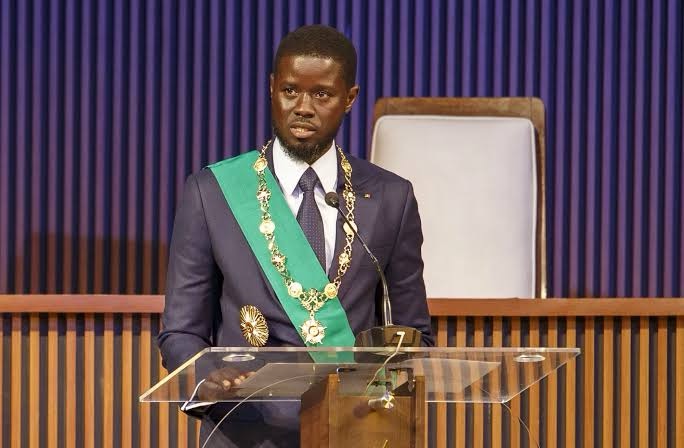

The hidden debt crisis has not only shaken the economy but also stirred political tension. Citizens are questioning the integrity of former officials who allegedly concealed true fiscal numbers. At the same time, President Bassirou Diomaye Faye’s administration faces the difficult task of maintaining social stability amid tightening economic conditions.

Political analysts argue that this crisis could become a turning point for genuine fiscal reform. Yet without international backing and effective debt management, Senegal risks slipping deeper into economic distress.

Market Reactions

Global markets responded with caution. Senegal’s eurobonds, once considered attractive, are now trading at steep discounts. Investors demand higher yields due to increased default risk, driving up the cost of borrowing.

International credit rating agencies have also warned of possible downgrades if the situation does not improve. A downgrade would further damage Senegal’s position in global capital markets.

The Road Ahead

The Senegalese government stands at a crossroads. On one side, it must quickly regain fiscal credibility and secure IMF support. On the other, it faces urgent domestic development needs that cannot be postponed. The combination of domestic financing, improved transparency, and economic rebasing may offer temporary relief.

However, economists caution that these measures are not enough. Senegal must pursue structural reforms in debt management, strengthen public accounting systems, and establish independent oversight to prevent misreporting from recurring. Support from multilateral institutions and donor countries will be vital to determine the success of Senegal’s recovery.

Conclusion

Senegal’s hidden debt crisis is a stark reminder that fiscal transparency is essential for economic stability. The country now faces the challenge of balancing development needs with financial discipline. The government’s ability to manage this crisis will shape Senegal’s future reputation in international markets.

Also read our related coverage on global fiscal crises in developing nations to see how similar patterns are emerging worldwide.