The global luxury beauty market is searching for new growth opportunities, and all eyes are now on India. With a population of 1.4 billion, the country is projected to become the “last bastion” for expansion in the premium beauty industry, as several major markets begin to slow down. Giants such as L’Oréal, Estée Lauder, Shiseido, and Amorepacific are competing to dominate a market expected to rise from 800 million US dollars in 2023 to 4 billion US dollars by 2035, according to a report by Kearney and LUXASIA.

India’s Untapped Potential

Although India’s overall beauty and personal care industry is worth 21 billion US dollars, the luxury segment only accounts for 4 percent. This figure is far below Southeast Asia, where the share ranges from 8 to 24 percent, or advanced markets such as the United States and China, which reach 25 to 48 percent. These conditions make India a wide-open field ready for global brands.

Sameer Jindal of Houlihan Lokey India calls the country the “last bastion of growth for premium beauty”. While other regions face saturation and competition, India offers fertile ground for long-term expansion.

Strategies of Beauty Giants

Estée Lauder

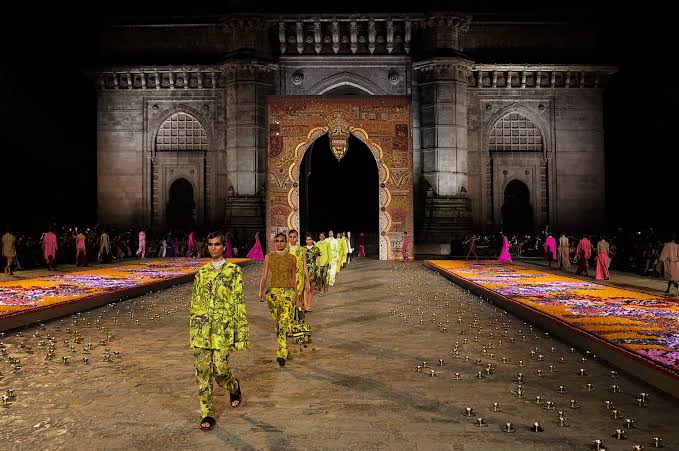

Estée Lauder has made India a top priority, targeting around 60 million urban women with rising purchasing power. The company launched locally relevant products like kohl eyeliner, while using digital data to reach consumers in mid-sized cities such as Siliguri in West Bengal. Collaborations with iconic Indian designer Sabyasachi Mukherjee further boost brand appeal among premium consumers.

The company also invested strategically in Forest Essentials, a local herbal brand, while supporting India-based beauty startups to strengthen its long-term foothold.

L’Oréal and Amorepacific

L’Oréal is focusing on young, digital-savvy consumers with campaigns that highlight modern beauty and aspirational lifestyles. Meanwhile, Korea’s Amorepacific is introducing the K-beauty ritual to India, offering step-by-step skincare regimens from cleansers and serums to moisturizers and sunscreens.

Shiseido

Shiseido expanded its reach by bringing NARS to the Indian e-commerce platform Nykaa. The Japanese giant is preparing to roll out more of its brands, tailored to the fast-evolving urban lifestyle.

Role of Retail and E-Commerce

Global expansion is being fueled by local retail support. Nykaa, Shoppers Stop, and Amazon India are broadening their distribution networks. Shoppers Stop plans to open 15 to 20 new beauty stores every year, aiming to raise beauty’s contribution to 25 percent of total revenues.

E-commerce platforms are also vital as India’s urban consumers increasingly shop online. Partnerships between global brands and local platforms are accelerating market penetration across both major cities and mid-sized towns.

Challenges and Opportunities

Despite vast potential, global firms face significant challenges in localizing products. India’s tropical climate, cultural preferences, and diverse purchasing power require careful adaptation. Indian consumers often show strong loyalty to traditional and natural-based products, which is why collaborations with local brands and the use of herbal ingredients are proving critical.

At the same time, urbanization, lifestyle changes, and a growing middle class with higher incomes will continue to drive demand for luxury beauty. With innovative strategies and sustained investment, India is set to emerge as a key pillar in the global beauty map.