Global economy shows early-year resilience, yet the latest Bank of Central Europe projections signal an unavoidable slowdown. World real GDP growth is forecast to drop to 3.3 percent in 2025, down from 3.6 percent last year. Key drivers include softening labor demand in the United States and declining retail sales in China. Meanwhile, the Organization for Economic Cooperation and Development notes unexpected strength in the first half of 2025, though recent indicators are dimming.

Impact of Weakening Demand in US and China

ECB’s September 2025 projections highlight how dynamics in two economic giants shape the global flow. The United States, with its still solid labor market at 4.2 percent unemployment, now faces wage slowdowns and hiring pauses. This curbs consumer spending power, echoing through European exports. On the flip side, China grapples with low consumer confidence and a property crisis, leaving retail sales sluggish and pressuring demand for imported goods.

This backdrop ties directly to simmering trade tensions. New US tariffs worsen the picture, though ECB deems their effect on the eurozone minor. Analysts stress the need for flexible monetary policies to weather these shocks.

Factors Behind US Labor Weakness

The US labor market displays fatigue signs after years of strong expansion. Unemployment holds steady at 4.2 percent, but annual wage growth cools by 0.5 percentage points from the prior quarter. The Federal Reserve watches this closely, as it may pave the way for further rate cuts. “We see downside risks from weak external demand,” said Christine Lagarde, ECB President, in her September press conference.

Data from the US Bureau of Labor Statistics confirms the trend. Hiring in manufacturing dipped by 15,000 jobs this month, largely due to tariff anticipation. Consumers shift to defensive spending, like basics, hitting German auto exports hard. Goldman Sachs economists predict this ripple could shave 0.2 percentage points off the US contribution to global growth.

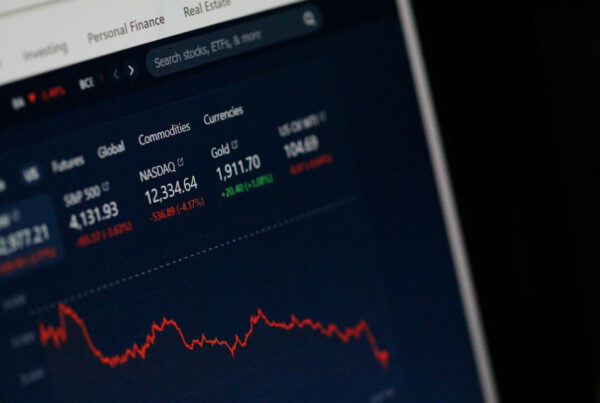

Market players react swiftly. Europe’s Euro Stoxx 50 index fell 1.2 percent after the ECB release. Still, analysts stay upbeat. “US resilience persists, but export diversification is key,” noted a Brookings Institution expert in a Reuters interview.

Decline in China’s Retail Sales

China confronts deep domestic hurdles, with retail sales growing just 2.1 percent year-on-year in August 2025. This falls well short of the government’s 5 percent goal, fueled by property recession fears and swelling household debt. Beijing responds with 500 billion yuan in fiscal stimulus, but results stay limited as shoppers hold back on big purchases.

China’s National Bureau of Statistics reports show online retail giants like Alibaba down 3 percent from peaks. European exports to China, especially machinery and chemicals, drop 8 percent. “This slowdown is not temporary; it’s structural,” asserted IMF senior economist Gita Gopinath in a virtual speech this week.

Meanwhile, European firms like Siemens adapt strategies. They boost investments in ASEAN markets to offset China losses. McKinsey analysis suggests without structural reforms, China’s growth could stall below 4 percent through 2027.

Eurozone Inflation Nears ECB Target

Inflation in the eurozone now brushes the 2 percent mark, a win for ECB monetary policy after post-pandemic turbulence. Headline inflation steadies at 2 percent in August, while core sits at 2.3 percent. Falling global energy prices and healed supply chains play big roles. Yet wage and service pressures linger as anchors.

This setting reflects a fragile balance. ECB has cut rates three times since June, lowering the deposit facility rate to 3.25 percent. The move bolsters growth without sparking price bubbles. Policymakers now eye fourth-quarter data to chart next steps.

Projections for Further Inflation Easing

Core inflation is set to ease to 1.9 percent in 2026, driven by softening wage pressures. Eurostat data reveals annual wage rises slowing to 3.8 percent from 4.2 percent. “Our inflation is under control, but we can’t drop our guard,” Lagarde emphasized, stressing vigilance.

European Commission analysis forecasts upsides from the green energy shift. Subsidies for solar panels and electric vehicles could trim production costs by 10 percent. Risks from commodity spikes due to extreme weather still loom, however.

Labor union responses mix. In Germany, IG Metall pushes for higher wage hikes to match inflation, while French service workers worry about cuts. Oxford Economics economists warn imbalances could spark social tensions if unaddressed.

ECB Monetary Policy Ahead

ECB likely holds a dovish stance at its October meeting. Staff projections indicate room for one more cut this year. “We prioritize price stability while supporting growth,” clarified board member Philip Lane in policy notes.

Latest eurozone manufacturing PMI climbs to 47.5 points, hinting at mild expansion. This offers hope for private investment. Geopolitical uncertainties, like the Ukraine conflict, could disrupt energy routes, though.

JPMorgan analysts predict rates falling to 2.5 percent by end-2026. They recommend ECB tighten collaboration with national governments for targeted fiscal stimulus.

Early-Year Resilience per OECD

OECD reports global growth proved tougher than expected in early 2025, especially in emerging economies. Industrial production surged 4 percent, spurred by tariff foresight. Global trade rose 2.5 percent before restrictions hit. September indicators now reveal slowdowns, with global PMI at 49 points.

This context underscores emerging markets’ role, like India and Brazil. They drive 60 percent of world growth this year. OECD highlights pre-tariff stockpiling as a main catalyst.

Boost from Industrial Production

Global industrial output grew faster than predicted, hitting 3.8 percent in Q2. Nations like Vietnam and Mexico capitalize on supply chain shifts from China. “This proves swift business adaptation,” stated OECD Secretary-General Mathias Cormann in the interim report release.

World Bank data backs the export manufacturing boom to the US, up 12 percent. European companies like Volkswagen relocate some production to Mexico, dodging 25 percent tariffs. Analysis shows this creates 200,000 new jobs in those regions.

Environmental challenges arise too. Higher output lifts carbon emissions 5 percent, straining Paris Agreement goals. UNEP experts urge green investments for mitigation.

Early Signs of Global Slowdown

Recent gauges like business confidence slip 3 points to 95 in the September survey. OECD projects world GDP easing to 3.2 percent this year from 3.3 percent in 2024. “Policy uncertainty acts as the main brake,” Cormann stressed.

Markets show reactions in Germany’s bond yields dropping to 2.1 percent. Investors seek safe havens amid Trump-era tariff fears. IMF economists caution escalation could trim 0.5 percentage points from forecasts.

Euro nations like Spain display resilience with 2.1 percent growth, fueled by tourism. Germany faces 0.2 percent contraction from weak exports, however. OECD advises diversification to shield from shocks.

ECB and OECD projections outline the global economy’s thin balance today. Growth slows yet early resilience sparks hope. Eurozone inflation stays in check, though US tariffs pose latent threats. Policymakers must act proactively to sustain momentum. For deeper insights, check related Olam News pieces like “US Tariffs’ Hit on European Exports” or visit official sources at ECB and OECD.