The Bank of England decided to keep its benchmark interest rate at 4 percent during the Monetary Policy Committee (MPC) meeting that concluded on 17 September 2025. The decision highlights the central bank’s dilemma as inflation remains well above target while economic growth stays sluggish. With inflation at 3.8 percent in August, policymakers stressed there is no safe room for further rate cuts this year.

Analysts view the move as a sign that the UK is still struggling to escape persistent inflationary pressures left over from the pandemic and the global energy crisis. Two MPC members pushed for a 0.25-point cut to 3.75 percent, but the majority voted to hold rates steady. The Bank also adjusted its quantitative tightening program, reducing planned government bond sales from 100 billion pounds to 70 billion pounds over the next 12 months.

Inflation Remains a Threat

Recent data show consumer prices rising more slowly than the peak in 2023, but still nearly double the 2 percent target. The Bank expects inflation to edge slightly higher in September before gradually declining toward target in the medium term. The biggest pressure comes from the services sector and wage growth, which has not slowed as much as expected.

This situation is compounded by weak domestic consumption and a labor market that is beginning to lose momentum. Unemployment rose to 4.7 percent in the second quarter, signaling that the economy is not fully absorbing its workforce. The central bank described this as slack or unused capacity within the economy.

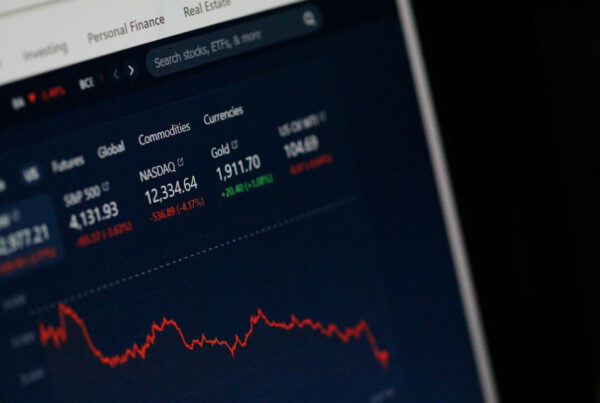

Market Reactions and Global Impact

The decision to hold rates triggered cautious reactions in financial markets. Sterling weakened after data showed government borrowing exceeded forecasts. Yields on long-term government bonds surged, reflecting investors demanding higher returns to offset fiscal risks.

Analysts from Goldman Sachs, Citigroup, and J.P. Morgan expect no further rate cuts until early 2026. Bond markets are now focused on how the UK manages the mix of fiscal and monetary policies. The government is expected to announce spending cuts or tax increases in the Autumn Budget to maintain fiscal credibility.

The impact extends beyond the UK. Global investors view BoE policy as a bellwether for Europe’s economic direction. With rates staying high, borrowing costs for households and companies will remain elevated. This could suppress consumption, slow investment, and reduce global liquidity.

Long-Term Risks

The Bank faces a classic dilemma. Holding rates high for too long could further weaken the economy, but cutting too soon risks reigniting inflation. External risks such as new US import tariffs, oil market volatility, and geopolitical tensions add to uncertainty.

Meanwhile, the IMF forecasts global growth at around 3 percent in 2025, rising slightly to 3.1 percent in 2026. However, the fund warned that protectionism, high debt levels, and expensive global borrowing costs could disrupt stability. Within this context, the BoE’s cautious stance is seen as consistent with preserving monetary credibility.

The Bank of England’s decision underscores that the international economy remains fragile. Inflation is not fully under control and fiscal risks are looming, leaving the central bank with little room to maneuver. Investors, businesses, and households must now adapt to a prolonged period of higher borrowing costs.

For deeper insights into how global monetary policies affect Southeast Asia, readers can continue to related articles on Olam News.