The global economy is currently under significant strain. Reports from major international institutions indicate a notable slowdown across nearly every region. The World Bank projects global growth at only 2.3 percent in 2025, well below historical trends. Meanwhile, UNCTAD warns of a decelerating trajectory that could push the world into a mild recession. These signals underscore that the world economy is in trouble, with pressures stemming from inflation, mounting debt, protectionism, and geopolitical conflicts.

Many nations face unresolved structural issues. Advanced economies struggle with declining productivity, while developing countries are burdened by debt and weak foreign investment. The situation is further complicated by protectionist policies disrupting global trade. Pressures from multiple directions are creating uncertainty, stalling corporate expansion plans, and slowing the machinery of the world economy.

Global Growth Under Pressure

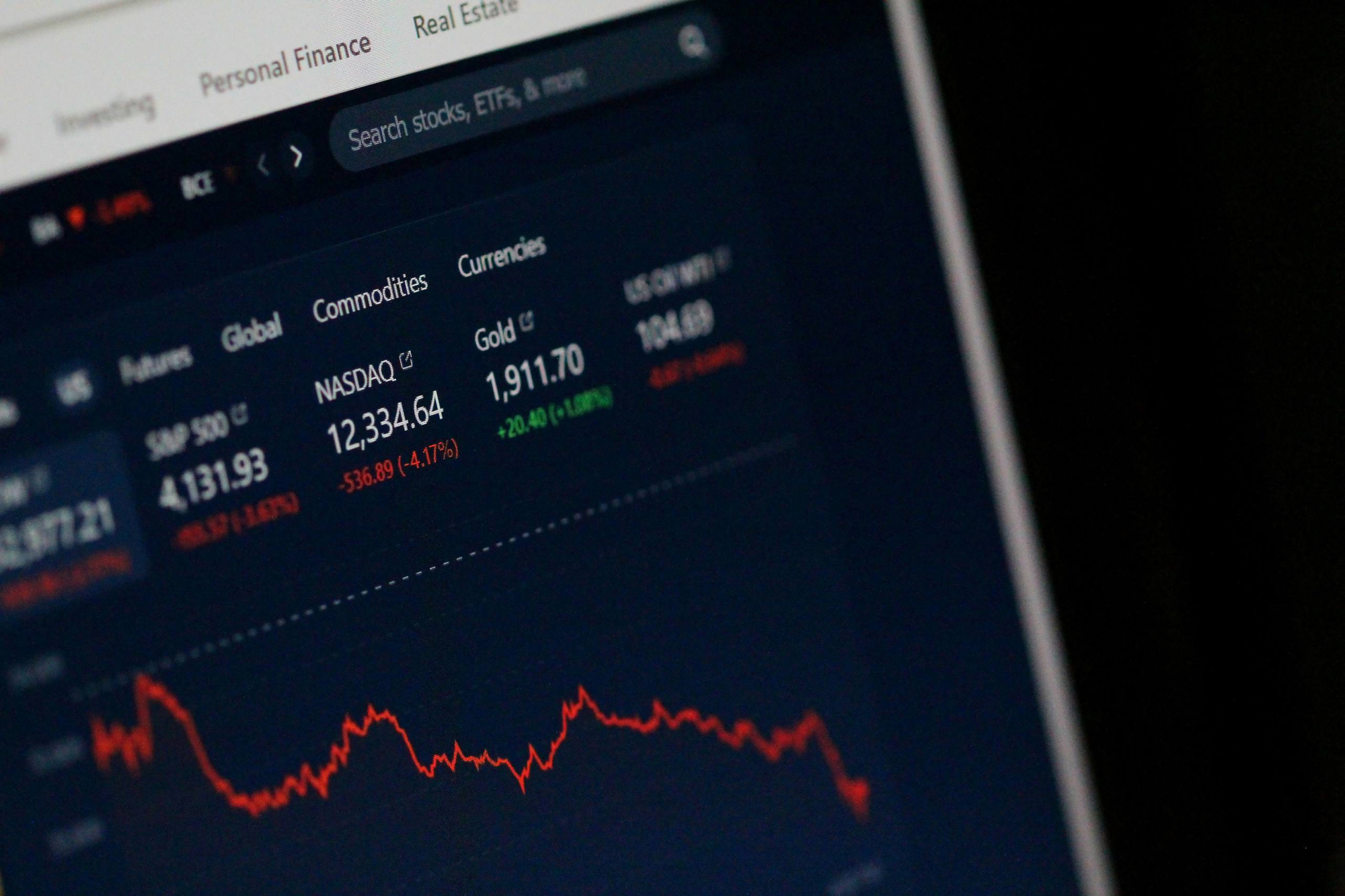

The challenging global environment has made it difficult for nations to sustain growth momentum. Morgan Stanley estimates global growth will fall from 3.3 percent in 2024 to just 2.9 percent in 2025. Projections suggest it may weaken further in 2026 if conditions do not improve. This decline is evident across both advanced and developing economies.

UNCTAD notes that international trade is facing serious deceleration. Higher tariffs, stricter import policies, and supply chain uncertainties have reduced cross-border flows. In addition, the World Bank warns that only a handful of Asian countries continue to show positive growth. Outside the region, most developing nations face grim prospects.

Mounting Debt in Developing Nations

Many developing countries are grappling with mounting debt burdens. A combination of high interest rates and weaker currencies has made debt servicing more costly. In some African and Latin American nations, over 30 percent of government revenue is now devoted solely to debt repayments. This leaves little fiscal space for infrastructure or public services.

The World Bank cautions that such debt pressures could trigger crises similar to those of the 1980s. Nations with limited foreign reserves are increasingly vulnerable to default. Meanwhile, global capital markets have grown more selective in their lending, narrowing financing options. This has placed many developing economies on a precarious edge between stability and crisis.

Persistent Inflation

At the same time, inflation, while somewhat easing, remains disruptive. Energy, food, and logistics costs have yet to normalize. Advanced economies like the United States and Europe have managed to bring inflation under tighter control, but price pressures linger. The European Central Bank has warned of renewed inflation risks should geopolitical tensions persist.

Persistent inflation erodes consumer purchasing power. Households are cutting back spending, while producers face higher input costs. Together, this combination slows domestic consumption, a key growth driver. This reinforces the reality that the world economy is in trouble.

Geopolitics and Global Trade

Geopolitical tensions have become one of the leading triggers of global instability. Rivalries between major powers—particularly the United States, China, and Russia—have disrupted trade flows and global investment. Conflicts across regions add uncertainty to both energy and food prices.

McKinsey reports that many multinational firms are delaying investments due to geopolitical instability. Executives prefer to safeguard liquidity rather than expand aggressively. As a result, foreign direct investment flows have slowed dramatically across numerous countries.

Trade Tensions

Import tariffs imposed by major economies are at the heart of slowing global growth. The United States has raised tariffs on key Chinese products, and China has retaliated in kind. This recalls the trade war of a few years ago, though the impact now is broader as it spans critical sectors such as technology and energy.

According to Reuters, such tariff battles could cut global growth by as much as 0.5 percent annually. Export-dependent economies are among the hardest hit. Meanwhile, consumers face higher import prices, further squeezing household budgets. This cycle has become an additional drag on the already weakened global economy.

Energy and Food Crises

Beyond trade, the energy and food crises continue to pose serious risks. Volatile oil prices are raising production costs worldwide. At the same time, disruptions in wheat supplies from Eastern Europe have worsened global food security. The UN’s Food and Agriculture Organization (FAO) reports that over 40 countries remain dependent on food imports vulnerable to price swings.

These crises have created another layer of uncertainty. Energy-importing nations bear heavier costs, while producing countries cannot always take advantage of higher prices due to limited capacity. This dynamic adds to the already complex challenges showing the world economy is in trouble.

Responses and Analysis

Various stakeholders have issued warnings and analysis on the global situation. Economists argue that without stronger international coordination, conditions could deteriorate further. Collective efforts are needed to stabilize trade, strengthen financial cooperation, and ease geopolitical tensions.

The World Bank, IMF, and OECD all stress the need for structural reform. Nations must improve productivity through innovation, education, and digital transformation. However, such reforms cannot deliver immediate relief. In the meantime, short-term pressures demand measures such as subsidies, price controls, or debt restructuring.

Views from Global Economists

Several leading economists describe the world as facing a “decade of slow growth.” Former US Treasury Secretary Lawrence Summers warns of a return to secular stagnation, where long-term growth remains low even if outright recessions are avoided. This reality forces governments to search for new strategies to stimulate economies.

Meanwhile, Christine Lagarde of the European Central Bank emphasizes that inflation remains the foremost threat. In her view, cautious monetary policy is still necessary, even if it further slows growth. The dilemma between curbing inflation and supporting expansion poses a major challenge for central banks worldwide.

National Responses

Countries are adopting varied strategies. The United States is prioritizing industrial policy and domestic protection. China is boosting fiscal stimulus to strengthen domestic demand. The European Union seeks to balance its green energy transition with economic stability. Yet these divergent strategies often heighten trade frictions.

Developing nations face an even sharper dilemma. They must balance fiscal stability, debt repayment, and urgent social needs. Without international support, many risk sliding into prolonged crises. These circumstances further underscore that the world economy is in trouble.

The weakening global economy paints a picture of a world in a time of mounting challenges. From slowing growth and rising debt to inflation and geopolitical strain, every factor compounds the next. While some nations remain resilient, the broader outlook is deeply concerning. The world economy is in trouble, and collective action is essential to prevent a deeper crisis. To dive further into sector-by-sector impacts, readers can follow Olam News’ extended coverage and analysis.