Nvidia has once again delivered record-breaking performance in its latest earnings report for the second quarter of fiscal year 2026. The U.S. semiconductor giant reported revenue of $46.7 billion, up 56 percent year-over-year, with adjusted earnings per share (EPS) reaching $1.05, slightly above Wall Street expectations. Despite these impressive numbers, Nvidia’s stock fell more than five percent in after-hours trading due to a narrow miss in data center revenue.

Record-High Revenue

Nvidia’s revenue surge was fueled by strong demand for artificial intelligence (AI) chips. According to the company’s report, the data center division contributed $41.1 billion, a 56 percent increase from the same quarter last year. However, the figure came in slightly below analyst estimates of around $41.3 billion. Investors saw this shortfall as a sign of possible cooling demand, especially amid uncertainty around U.S. export regulations to China.

H20 Chip Factor and Export Rules

One notable element in the report was the $180 million boost from sales of H20 chips, previously restricted from being sold in China. Nvidia redirected these chips to overseas customers, which helped raise EPS to $1.05. Without this boost, EPS would have been closer to $1.04. Still, the company continues to await official guidance from the U.S. government on export licenses for China. Nvidia has already agreed to share 15 percent of chip sales revenue with the U.S. government as part of the conditions for export approval.

Outlook for Next Quarter

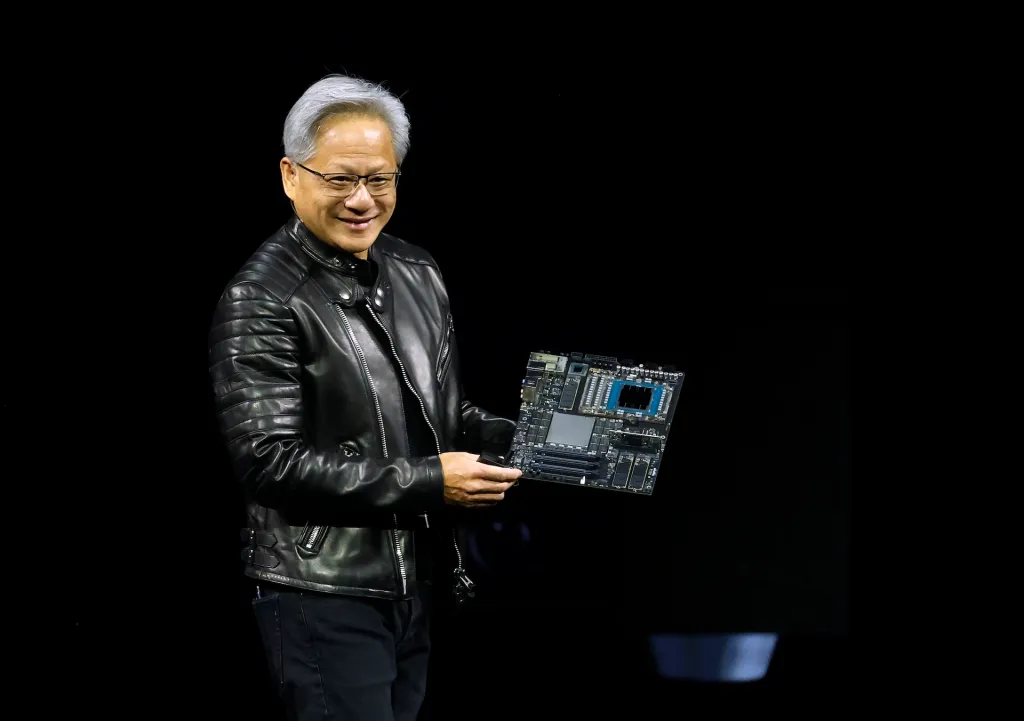

For the third quarter, Nvidia projects revenue of about $54 billion, slightly above Wall Street’s consensus estimate of $53.8 billion. This optimistic forecast reflects the company’s confidence in continued strong AI chip demand, even as the China situation remains unresolved. CEO Jensen Huang stressed Nvidia’s leadership in global AI infrastructure and reaffirmed the company’s commitment to advancing next-generation computing.

Massive Share Buyback

Alongside its earnings, Nvidia announced a $60 billion share buyback program, aimed at bolstering investor confidence amid market volatility. Since the start of the fiscal year, the company has already returned more than $24 billion to shareholders through dividends and share repurchases. This buyback move underscores management’s confidence in Nvidia’s long-term growth.

Market Reaction and Investor Sentiment

Despite strong results, Nvidia shares slid in after-hours trading. Investors expressed concern about the slight miss in data center revenue, which has been the main growth engine for the company. Analysts noted that Nvidia’s stock valuation is already extremely high, making it vulnerable to any minor disappointment. According to Reuters, options markets were pricing in potential volatility of up to six percent following the earnings release.

Geopolitical Risks and the Future of AI

Geopolitical risks remain a key challenge for Nvidia. Stricter U.S. export controls on China could impact the company’s global market share. At the same time, concerns are rising about a potential bubble in the AI sector, with tech valuations soaring over the past two years. Still, many analysts remain bullish on Nvidia’s business fundamentals, pointing to its unmatched dominance in AI chips.

Conclusion

Nvidia’s Q2 FY2026 performance set a new milestone with record revenue. Yet the stock market reaction highlights how high investor expectations have become. Export restrictions to China and reliance on the data center segment will be critical factors shaping Nvidia’s growth trajectory going forward.